By Ed Pierce, Contributing Editor

The 2021 IARA Virtual Conference was conducted last week the International Automotive Remarketers Alliance and featured important presentations for remarketers and fleet professionals interested in remarketing trends for 2021 and beyond.

NAAA Leaders Kick Things Off

The conference kicked off with opening comments by Laura Taylor, Charleston Auto Auction Accelerate and former National Auto Auction Association (NAAA) president. She began by noting that, although everyone knows how chaotic 2020 went, the current situation is really good for remarketers. “Conversion rates are high. The inventory may be a little short, but we’re selling everything that’s coming through the door.”

She noted NAAA’s actions taken to ensure that independent auctions had a “playbook for COVID” and a plan to start back up. “We’re proud of that, and glad to start seeing a little bit of normalcy back in places. I believe we’re bearing through it and looking to be normal again soon.”

NAAA president-elect Charles Nichols of BSC America, followed Laura and stressed “how nice it is to be able to run cars again.” And noted “everybody has been so resilient through all of this. I’ve not seen a group be more cohesive. It’s a real statement to the industry, our organization, and our people.”

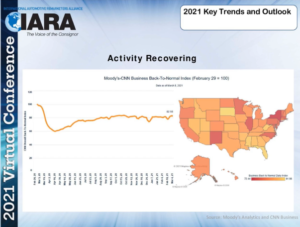

The IARA outlook for the economy summarized some of the positives for businesses as a whole and for the remarketing industry.

This slide from the conference set the stage for the positive outlook. The Moody’s Analytics & CNN Business Back-to-Normal marked four consecutive weeks of growth and the highest reading since the pandemic ground the U.S. economy to a halt last April.

2021 Key Trends & Outlook

The conference’s first educational session, Key Trends & Outlook, featured expert insight from Jonathan Smoke and Tom Kontos.

Jonathan leads Cox Automotive’s economic industry insights team, which tracks new and used vehicle sales, supply, prices, retail and fleet demand, consumer credit and auto financing, and dealer sentiment. His views on the economy and the auto industry are featured regularly in industry and national news outlets.

Tom Kontos is Chief Economist for KAR Auction Services Inc. He is author of Pulse, a report on economic conditions and the new and used vehicle markets in the US and Canada, and the Kontos Kommentary, a monthly e-mail report and video on wholesale used vehicle price trends. Tom is a past recipient of the Ed Bobit Icon of the Automotive Industry Award.

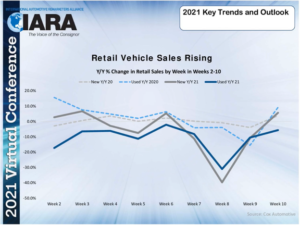

According to Jonathan, declining COVID-19 case trends and increasing vaccination rates are contributing to U.S. automobile dealers feeling mostly optimistic about the automobile market in the coming 90 days. The Cox 90-day outlook index jumped to its highest level since the onset of the global pandemic, indicating automobile dealers in the U.S. believe the market will be strong in the coming three months.

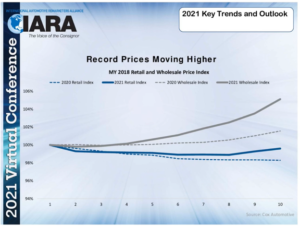

Increased Pricing

Jonathan pointed out that March has seen an acceleration in pricing that will exceed an incredible February performance.

Driven by tax refund season and the just-signed rescue package, increases are likely to persist until June. Jonathan does expect depreciation to be higher than normal in the back half of the year. But, he added, “By the year’s end, we don’t think we’re going to fully work off the gains that we are going to have in the Spring. That means, the best possible time for a remarketer is going to be between now and June. But the back half of the year is going to continue to be very favorable because the economy is recovering. In fact, the latest GDP forecast suggests that the U.S. Economy will be fully recovered by the third quarter of this year.”

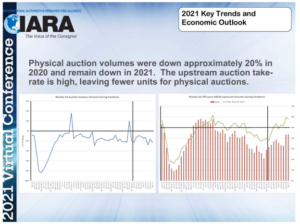

Jonathan addressed the fortunes of auction houses next, explaining that decreasing volumes especially in rental fleet vehicles would continue: “Because the rental car companies stopped buying vehicles last year, there is no need for replacement vehicles now. As a result, there will not be substantive relief in 2021. Stimulus money will affect repossessions, too, so that market will be down.”

The Cox economist projected lower total lease volumes, “We have an accelerated decline in those vehicles actually showing up at auction because the retail market is so strong. Most of the vehicles reaching the end of their maturity are in an equity position so the consumers find it more compelling to keep them.

“The grounding dealers want every unit they can possibly get because they can play arbitrage, but they also have a strong retail market. What we’re basically seeing is a huge decline driven by the values in those vehicles showing up in the auction market.”

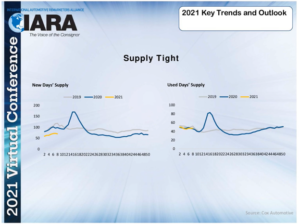

Kontos Confirms Tight Supply

Tom Kontos dug deeper into the supply situation that his co-presenter referenced: “There’s really a lack of supply on all fronts. So, of course, with that being the case, prices are very strong. Prices have been very strong, double-digit year-over-year increases.”

Added Tom, “There’s several things you can hypothesize about, but fundamentally, not only has supply been tight and demand been strong, but we have seen a fundamental change in delivering vehicles and the draw for those vehicles from savvy online buyers. I think that’s part of what’s driving prices higher yet, besides the law of supply and demand.”

Busy Itinerary

The rest of the IARA conference day was included panelist discussions on key topics affecting the remarketing industry, including:

- Adapting to a Socially Distanced World

- Is Your Condition Report Making the GRADE?

- Dealer Insights

- Transportation and Logistics: Managing Physical Assets Through a Digital Transaction

- Consignors Rising to Change

Next week, we will summarize the take-aways from the “Consignors Rising to Change” session.