By Ed Pierce,Contributing Editor

NTEA Provides Work Truck Industry Overview and Market Forecast

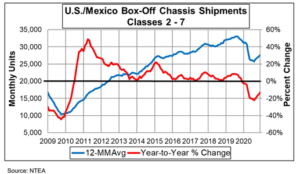

NTEA’s staff economist Steve Latin-Kasper shared the latest forecasts for North American economic activity, work truck and truck equipment sales and shipments, and metals and fuel prices.

Compared to 2020, Latin-Kasper projected 10% growth for the industry as a whole (and much better than that in some segments). The big winners currently expected are Classes 2–6. We expect Classes 7 and 8 to turn it around in the second half with some growth at the end of the year.

His list of positives and negatives for the year ahead comprised:

Positives

- Good credit availability

- Near-term moderate inflation

- Historically low interest rates

- Residential construction growing

- Last-mile delivery opportunities

Negatives

- Labor market imbalances

- COVID-19 remains an issue

- Debt (government, business, consumer)

- State/local equipment expenditures

- Political uncertainty (U.S. and international)

NTEA Helps Fleets Optimize Work Truck Specs

During this WTW21 session, Chris Lyon, NTEA’s fleet relations director, explained explored how changing elements in their work truck specifications can be the foundation for future fleet improvements using the association’s specification development tool.

“In order to write quality specifications, it’s important to understand the foundation for you, as a spec writer, as well as who will be ultimately taking your specification and turning it into a work truck,” said Lyon.

He defined the various specification types, highlighting the more common formats that are widely used, including performance, proprietary and engineering spec’s. Lyon walked attendees through the spec’ing process from beginning to end, covering a wide range of key steps, such as

- Pinpointing stakeholders in the process

- Importance of drive and duty cycles

- Identifying customer needs

- Determining if spec changes are needed

- Defining performance requirements

- Selecting the spec writer

- Controlling costs

For more information on proper spec development, fleet managers and spec developers can visit NTEA’s Vehicle Specification Process Guide at www.ntea.com/specguide .

Implications of Vehicle Certification Labeling Requirements

Key takeaways

- All vehicles must be certified in the final stage.

- All manufacturing operations performed on a motor vehicle before the first retail sale for use must be certified.

- All vehicles must have a certification label indicating they conform with all applicable safety standards.

- For more vehicle certification resources, visit ntea.com/certification.

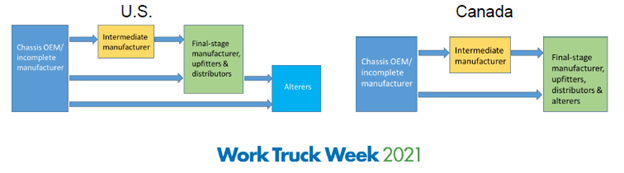

NTEA Director of Technical Services Director Bob Raybuck reviewed how to identify and complete required vehicle certification labels. He shared the importance of payload analysis, weight distribution and Federal Motor Vehicle Safety Standard compliance analysis in the certification process. In addition, attendees learned how the cloud-based WorkTruckCert program can streamline vehicle certification labeling and printing.

Raybuck overviewed the four types of motor vehicle certification: incomplete vehicle, intermediate-stage, final-stage and altered-stage certification. Attendees learned ways certification can be affected by vehicle parameter and how potential performance is affected. Record retention, recall and remedy, and penalties for the U.S. and Canada were also discussed.

Who is required to certify? If you are a manufacturer as designed under federal and Canadian motor vehicle regulations, you are required to certify that the vehicles you manufacture conform to all applicable safety standards, and must affix a certification label.

WTW21 Session Portrays Alternative Fuels Landscape

Dave Schaller, industry engagement director at North American Council for Freight Efficiency (NACFE); Steve Sokolsky, program manager at CALSTART; and John Walton, chair of Chicago Area Clean Cities, overviewed the alternative fuel landscape, new technologies and key energy-saving strategies.

Sokolsky began the session by overviewing tools CALSTART developed for fleets planning and developing electrification efforts. Four key tools he identified as critical to driving market success include a Policy and Action Toolkit for planners; Zero-Emission Technology Inventory resource designed for fleet managers; Total Cost of Ownership (TCO) Calculator; and Infrastructure Planning Guide, coming soon, for fleets, utilities and planners. More details are available at globaldrivetozero.org/tools.

Schaller discussed NACFE’s founding pillars — to scale current technologies and improve information flow — as well as the addition of a third goal, guiding emerging technologies, over the past several years.

He noted, “Right now, there are nearly 20 different ways to power medium-duty/heavy-duty vehicles and trailers. It’s exciting to see the opportunities to look at different ways to bring us carbon reduction. They’re not all zero, but a lot that are easier short-term things, such as renewable diesel.”

Schaller then discussed available NACFE resources, including Confidence Reports reviewing available fleet technologies, the Annual Fleet Fuel Study, Run On Less Demonstrations and Electrification Guidance Reports (all available at www.nacfe.org ).

Finally, Walton shared steps and strategies to help ensure organizational buy-in for alternative fuels adoption.

- Determine full cost to introduce a new fuel

- Encourage end-user involvement with decisions

- Bring in demo vehicles for mechanics and maintenance staff

- Determine which fuels/technologies work for your application

- Look for incentives, grants and government funding

- Don’t forget the importance of driver training

CALSTART spokesperson Steve Sokolsky updated the WTW21 viewers on the organization’s tools for driving to zero emissions.

DOE’s Sustainable Transportation Strategy

The Department of Energy’s Office of Energy Efficiency and Renewable Energy announced upcoming programs to further support the work truck industry at the WTW21.

Acting Deputy Assistant Secretary for Transportation Michael Berube, and Acting Assistant Secretary Kelly Speakes-Backman shared key details on three notices of intent (NOI), which formally indicate DOE’s preparation to release funding opportunity announcements in the coming months.

- SuperTruck 3 — The Vehicle Technologies Office and Hydrogen and Fuel Cell Technologies Office are interested in partnering to develop and demonstrate R&D concepts to enable higher efficiency, low-emission medium- and heavy-duty trucks and freight systems.

- Low Greenhouse Gas Vehicle Technologies Research, Development, and Deployment — This NOI will invite innovative solutions for on- and off-road vehicles to support the reduction of emissions and increased efficiencies in the transportation sector.

- Bioenergy Technologies Office Scale-Up and Conversion — This NOI anticipates supporting high-impact technology research, development, and demonstration to bolster the body of scientific and engineering knowledge needed to produce low-carbon biofuels at lower cost.

Potential applicants can visit eere-exchange.energy.gov to review NOIs in detail and prepare applications.

Acting Deputy Assistant Secretary for Transportation Michael Berube reviewed the challenges and opportunities of implementing a sustainable transportation strategy.

Future Perspective on Global Van and Truck Market

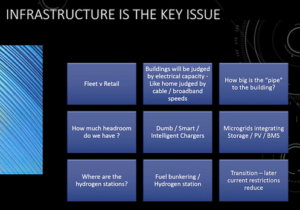

Tim Campbell, managing director at Campbells Consultancy, provided perspective on the global van and truck market at WTW21, identifying current and future issues. He addressed the battle of disruptors versus legacy manufacturers and how Europe’s goal to end production of gas and diesel vehicles by 2040 will impact the United States and truck equipment industry.

In discussing the importance of harmonization between North America and Europe, Campbell said, “What was a 3,000-mile gap is now probably a 30-mile gap. We are now weighted to each other in terms of research and development, and product. This will not stop — it is continuing.”

During this session, Campbell shared insights, perspectives and updates on:

- Trends over the last 10 years, and U.S. market expectations over the next three

- Light vans, which continues to be a growing sector

- Truck market developments

- How battery electric and hydrogen have attracted new light van and heavy truck players into the market, as well as anticipated industry impacts over the next 10–20 years

- Current and future buying habits

- Watch infrastructure to project battery vs. fuel cell market penetration

- How all of these trends will affect work truck industry businesses

Watch infrastructure to project battery vs. fuel cell market penetration

Navigating Historic Industry Transformation: A Journey to Zero

Paul Rosa, senior vice president of procurement and fleet planning for Penske Truck Leasing, shared perspective on the timeline surrounding the journey to zero emissions. Rosa told attendees that customers “need to be ready, but need to be patient” as the journey isn’t going to happen overnight. He emphasized, in addition to opportunity, the years to come will be filled with learning curves, questions and unknown challenges to overcome.

Rosa discussed four main factors that need to be determined before purchasing an electric vehicle: range, weight, cost and charging. He overviewed infrastructure, facility and charging factors, and the difference between what utilities control versus what companies/customers can control. Rosa said depending on fleet size, there can be exponential costs surrounding upgraded infrastructure and making an electric facility operational.

Rosa explained three main things he strongly recommends for attendees on their journey to zero emissions — have a goal, find a source and stay informed.

Penske’s long-term view of the journey to zero emissions

IHS Markit North American Work Truck Market Forecast

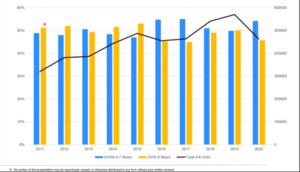

IHS Markit presented a 2021 North American economic forecast, with insights on U.S., Canada and Mexico, as well as 2021–2025 work truck market predictions, at the WTW21 conference. Participants learned differences between U.S. regions, along with data on average age of trucks by weight class, and key end-use market forecasts

GVW 4-8 New Registrations: % Share GVW 8 recedes

Andrej Divis, director, automotive, global heavy truck research, discussed new registration trends for 2020 based on gross vehicle weight, business vs. individual owners, fleet size, manufacturer units and region.

Overall, Class 4–8 new registrations collapsed by a fifth in 2020 while Class 5 rose nearly 20% compared to previous years. Light vehicle (Class 1–3) sales fell about 15%, with Class 1–3 vans declining about 27%. He also overviewed HIS Markit capabilities, including tracking changes of ownership for Class 1–8, which increased by 14% in 2020.

In terms of the forecast, Divis mentioned the U.S. economy will likely see an expansion of 5.7% in real terms compared to prior years. A sharp recovery is expected for Class 8 registrations, up well over 10% in 2021. In 2023, the pace of the economy might slow down but healthy growth is expected in 2024 and 2025. Class 4–7 registrations are expected to slightly rise in 2021 and remain steady through 2025.